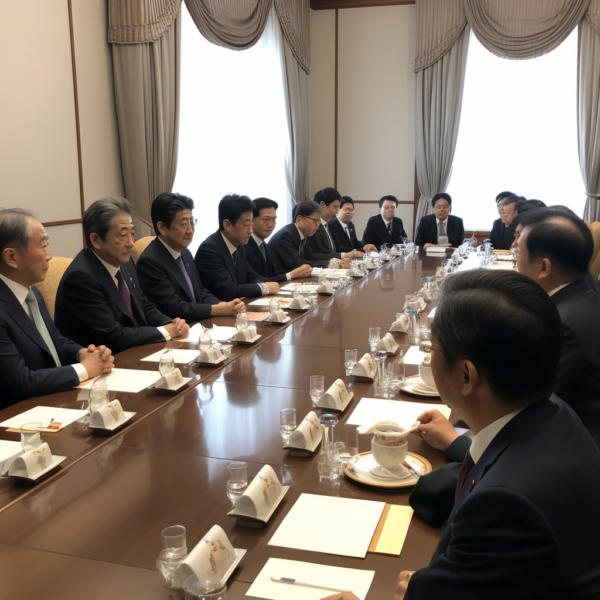

The looming threat of a U.S. debt default poses significant risks to China and Japan, who are the largest foreign investors in U.S. government debt, holding $2 trillion of the $7.6 trillion in U.S. Treasury securities held by foreign countries. As historically safe investments, U.S. Treasury bonds have allowed these nations to securely store their dollar earnings. However, the potential fall in value of U.S. Treasuries due to a U.S. default would result in decreased foreign reserves for both countries, limiting their ability to fund essential imports, service foreign debts, and support their currencies.

Moreover, a U.S. default could trigger a global economic downturn, impacting the world’s economies, including China’s fragile recovery and Japan’s emergence from stagnation. As China and Japan rely on the U.S. for substantial trade support, a slowdown in the U.S. economy would negatively affect exports, job markets, and overall economic health in both countries.

While the prospect of a default could prompt a shift in financial strategies, particularly a push for China to decrease its dependence on the dollar, analysts note that this transition would be challenging. China’s current restrictions on financial flows and its limited integration with global financial markets present significant obstacles. Regardless of the outcomes, the imminent threat of a U.S. default has heightened economic uncertainties worldwide, with countries on edge as they wait for the U.S. to take steps to avoid a potential default.